Buying a condo in Singapore can be exciting, but it’s easy to overlook some hidden costs. These expenses often catch buyers off guard, adding significant amounts to the final price. Understanding these costs in advance helps you budget accurately, avoid surprises, and enjoy a stress-free buying experience. Here’s a guide to five essential hidden costs to consider, with real-life examples for added clarity.

1. Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD)

What It Is: When you purchase a property in Singapore, you’ll need to pay Buyer’s Stamp Duty (BSD). This tax applies to all residential properties and is calculated based on a percentage of the purchase price. If you’re buying a second or subsequent property, you’ll also pay an Additional Buyer’s Stamp Duty (ABSD). The ABSD rate varies based on your residency status and the number of properties you already own.

Real-Life Example: Suppose you’re a Singaporean buying a second condo for $1,000,000. The ABSD rate for a Singaporean’s second property is 20%, adding $200,000 to your purchase. If you’re a foreign buyer, the ABSD rate for any property is currently 60%, meaning you’d pay an additional $600,000 on a $1,000,000 condo.

Why It’s Important: BSD and ABSD are significant fees that add to your property’s upfront cost. These costs can dramatically change the final amount you’ll need to secure a condo.

What to Do: Calculate BSD and ABSD before making any decisions. Your real estate agent or financial advisor can help confirm the exact amounts. Including these costs in your budget ensures you’re not caught off guard when it’s time to make the payment.

2. Legal and Conveyancing Fees

What It Is: Legal fees are another essential cost that many buyers overlook. These fees cover necessary paperwork, title searches, and the transfer process. Conveyancing fees ensure the legal transfer of ownership between the seller and the buyer.

Real-Life Example: If you’re working with a reputable law firm, you might expect to pay between $2,500 and $3,500 in legal fees. The exact amount depends on factors like the property type, firm reputation, and specific services required.

Why It’s Important: Without setting aside funds for legal fees, you could find yourself short on cash when it’s time to finalize the transaction.

What to Do: Plan to budget about 0.4% to 0.5% of the property price for legal and conveyancing fees. Before committing to a law firm, ask for a breakdown of services to understand exactly what you’re paying for and whether any additional fees might apply

3. Maintenance Fees and Sinking Fund Contributions

What It Is: When you buy a condo, you’ll also be responsible for maintenance fees. These monthly fees cover the upkeep of shared amenities like swimming pools, gyms, and landscaping. In addition to regular maintenance, there’s a “sinking fund” contribution. This fund goes toward major repairs, such as repainting the building or repairing elevators.

Real-Life Example: Maintenance fees vary widely. A high-end condo in Orchard might charge $500 per month, while a condo in a suburban area may only charge $200. Over time, these fees add up and become a significant expense.

Why It’s Important: Maintenance fees and sinking fund contributions impact your long-term budget. They’re especially crucial for buyers who plan to hold the property as an investment.

What to Do: Ask for a breakdown of monthly maintenance fees and sinking fund contributions from the condo’s management. Check if there are any upcoming repairs or upgrades, as these could temporarily increase fees. Knowing these costs upfront will help you avoid surprise expenses down the road.

4. Renovation and Interior Design Costs

What It Is: Many condos, especially new builds, are sold as “bare” units, leaving interior work up to the buyer. Even fully finished condos often need customization to suit a new owner’s taste and needs. These upgrades can range from simple painting to full-scale renovations of kitchens and bathrooms.

Real-Life Example: A basic renovation for a small condo might cost around $30,000, covering necessities like flooring, paint, and cabinetry. However, high-end condos in luxury areas like Marina Bay may need $100,000 or more in renovations and interior design to match the upscale ambiance.

Why It’s Important: Renovation costs are easy to overlook but can become a major expense. First-time condo buyers, in particular, may not anticipate the cost of transforming a bare unit into a comfortable home.

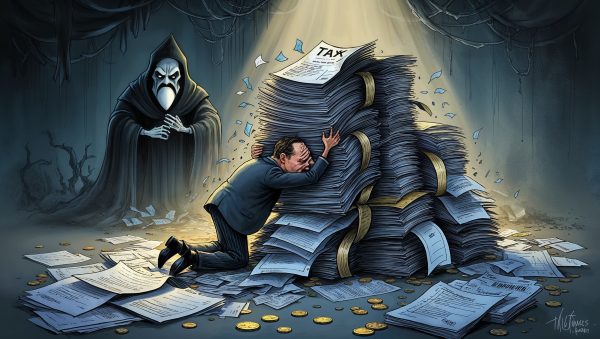

5. Property Taxes and Mortgage Insurance

What It Is: Property taxes are an annual cost based on the Annual Value (AV) of your condo. For owner-occupied properties, the tax rate is lower. However, if you plan to rent out your condo, you’ll face a higher tax rate. Additionally, mortgage insurance is often required for high-value loans, offering security for the bank in case of unexpected financial difficulties.

Real-Life Example: For a condo with an AV of $36,000, the property tax could be around $1,440 annually if you occupy the property. If you decide to rent it out, however, the tax rate may increase significantly, depending on the AV. Mortgage insurance can also add an annual premium, especially on large home loans, which some buyers might overlook.

Why It’s Important: These recurring expenses affect your long-term budget. Ignoring them can lead to financial strain, especially if you’re managing multiple costs.

What to Do: Use online property tax calculators to estimate your taxes based on your condo’s location and AV. Talk to your lender about potential mortgage insurance costs to understand their impact on your monthly payments. Factoring in these costs from the start helps you maintain a realistic financial plan.

To make the most of PSF data, consider the following tips:

- Compare with Similar Properties: Don’t just look at one property’s PSF. Compare it to similar properties in the area to understand local market trends.

- Examine Property Upgrades: Properties with recent upgrades may have a higher PSF, but this can add immediate value and comfort to the buyer.

- Factor in Long-Term Value: A lower PSF in an up-and-coming area could provide better value over time compared to a high PSF in a location with limited future growth.

Using these tips, you can maximize the value of PSF data in your property decisions.

Conclusion

Buying a condo in Singapore involves more than just the property price. Hidden costs like stamp duties, legal fees, maintenance fees, renovations, and recurring taxes can quickly add up. By understanding and budgeting for these expenses, you’ll avoid financial surprises and make a more informed investment. Consulting a property expert or financial advisor can also provide clarity on costs you might overlook, ensuring you enter your new home with confidence and peace of mind.

Anticipating and planning for these hidden expenses helps you enjoy your condo without unexpected stress, knowing you’ve budgeted for every part of the ownership journey.

Remember, PSF is just one part of the equation. Always consider other factors like location, building condition, and market trends to ensure you’re making the best possible investment or home purchase decision.