What is a Freehold Condominium

Definition of Freehold vs. Leasehold Properties

In Singapore, property ownership generally falls into two categories: freehold and leasehold. Freehold condominiums grant owners perpetual ownership of the property, meaning the property can be held indefinitely without the need for renewal. Leasehold properties, on the other hand, have a finite tenure, typically either 99 years or 999 years. Once the lease period expires, the ownership of the property reverts to the government or original landowner. For investors seeking long-term security, freehold condos are often favored due to their indefinite ownership status, providing a sense of stability and control.

Why Freehold Condos are Unique in Singapore

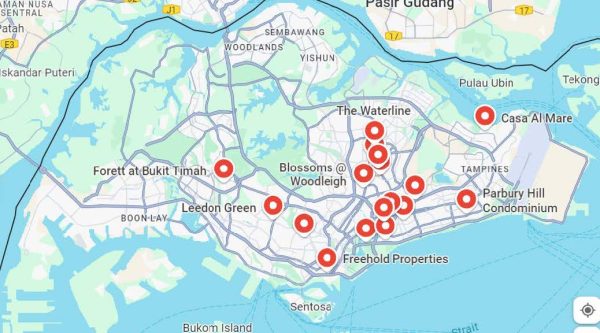

Freehold properties are relatively rare in Singapore, comprising about 20% of the country’s land. Most land is held on leasehold terms, making freehold condos especially desirable among investors and homeowners who prioritize asset longevity. These freehold properties are primarily located in specific residential areas, often in desirable neighborhoods, which enhances their appeal and potential for value appreciation. Because of this scarcity, freehold condos are viewed as both a stable investment and a legacy asset that can be passed down through generations.

If we look at the median unit price over the last 5 years, it is apparent that freehold condominiums have always commanded a good premium over their counterparts.

Diving into the Data

If we look at the median unit price over the last 5 years, it is apparent that freehold condominiums have always commanded a good premium over their counterparts.

Key Benefits of Freehold Condominiums in Singapore

Investment Stability in a Volatile Market

Freehold condominiums are highly sought after in Singapore’s dynamic real estate market for their long-term investment stability. Unlike leasehold properties, which may face depreciation concerns as the lease period shortens, freehold properties hold their value more steadily over time. In high-demand areas, such as prime districts, freehold condos have proven resilient, even in market downturns. This makes them an attractive choice for investors who are concerned about fluctuating property values and want a more secure investment option.

Long-Term Value Retention and Appreciation

One of the greatest advantages of freehold condos is their potential for long-term value appreciation. The scarcity of freehold properties in Singapore often makes them more desirable, particularly in neighborhoods with strong development potential and accessibility to key amenities like MRT stations, schools, and business hubs. Investors looking to build a secure, appreciating asset may find that freehold condos in popular areas are a solid choice, providing the potential for future capital gains.

Fewer Depreciation Concerns

Leasehold properties tend to depreciate in value as their tenure nears expiration, often impacting their resale value and appeal to future buyers. Freehold condos, however, avoid this issue, as they are not bound by time limits. This lack of depreciation concern makes them especially valuable for long-term ownership and for investors like James who are focused on minimizing asset risk while building a legacy asset that can be passed down to future generations

Navigating the Market for Freehold Condos in Singapore

Understanding Pricing Factors

Freehold properties in Singapore often come at a premium due to their long-term benefits and scarcity. Key factors affecting freehold condo prices include location, proximity to MRT stations, and nearby amenities. For instance, The Nassim, a freehold luxury condo in District 10, commands higher prices due to its prime Orchard/Tanglin location and exclusivity, with units priced upwards of SGD 3,000 per square foot. Similarly, MeyerHouse in District 15’s East Coast area is another freehold property known for its premium pricing due to its proximity to East Coast Park, high-end facilities, and enduring appeal among families and investors.

Demand for freehold condos is driven by the scarcity of new developments, especially in prime districts where land availability is limited. For example, The Avenir in River Valley is a new freehold development in District 9 that quickly attracted buyers due to its rare status in a well-established area. Located near Orchard and the Singapore River, it benefits from easy access to amenities and solid future growth potential. Likewise, Amber Park in District 15 has seen considerable demand for its freehold status in a coveted neighborhood, where new freehold projects are rare.

Comparing Freehold and Leasehold Condo Prices

While freehold condos tend to have a higher upfront cost, their enduring value makes them attractive for long-term investors. In comparison, leasehold properties like D’Leedon, a 99-year leasehold condo in District 10, offer more affordable prices per square foot but may face depreciation as the lease progresses. For buyers focused on asset longevity and stability, the premium of freehold condos can be justified by their resistance to lease-related devaluation. By contrast, leasehold properties may appeal to buyers seeking shorter-term investments or those who prioritize affordability.

These examples illustrate how freehold condos provide not only security and value retention but also cater to a market seeking exclusivity and the assurance of a stable asset in Singapore’s ever-competitive real estate landscape.

Financing Options and Considerations for Freehold Condos

Understanding Financing Challenges and ABSD Requirements

In Singapore, the Additional Buyer’s Stamp Duty (ABSD) can significantly impact financing decisions, especially for investors purchasing multiple properties. For instance, a Singaporean purchasing a second property faces an ABSD rate of 20%, while foreigners face a 60% ABSD on any property purchase. This was notably experienced by investors in luxury freehold developments like Wallich Residence in Tanjong Pagar. Despite its premium prices, foreign buyers continue to invest in Wallich Residence due to its status as a freehold property in the Central Business District (CBD). To manage the ABSD cost, some investors may choose to co-own with family members or take advantage of trust structures, while Singaporeans may apply for the ABSD remission if buying with a spouse

Mortgage Choices and Long-Term Investment Planning

Choosing the right mortgage is essential for maximizing the returns on freehold condo investments. For instance, investors in Leedon Residence, a luxury freehold condo in District 10, have favored fixed-rate mortgages to secure stable payments for high-value properties. Fixed rates provide the stability needed for long-term planning, aligning well with the perpetual ownership of freehold properties. On the other hand, progressive payment schemes are often chosen for under-construction condos like One Holland Village Residences, allowing buyers to pay in stages and manage cash flow more effectively until the property is complete.

Calculating Potential Return on Investment (ROI)

Freehold condo investments in prime locations often promise robust rental yields and long-term appreciation. For example, properties such as South Beach Residences, a luxury freehold condo near Marina Bay, are in high demand among expatriates, making them ideal for investors seeking rental income. With rental yields around 3-4% annually in prime areas, these freehold condos often yield better long-term returns than their leasehold counterparts. By calculating ROI based on both rental yield and potential property appreciation, investors gain clarity on the financial benefits that a freehold property can provide.

Key Factors to Consider When Buying a Freehold Condo

Location plays a vital role in property value. Properties near amenities, reputable schools, or MRT stations tend to retain and increase in value. For example, freehold condos in District 15’s East Coast are popular among families and expatriates, offering both lifestyle appeal and investment growth potential

Evaluating Facilities and Maintenance Costs

Condo amenities—such as pools, gyms, and playgrounds—contribute to rental demand and resale appeal. Choosing a condo with well-maintained facilities enhances value retention and makes it easier to attract high-quality tenants, especially for those looking to rent.

Future Development and Infrastructure Plans

Government and private development plans can impact property values significantly. Knowing about upcoming MRT lines, retail centers, or business hubs can help investors anticipate value increases in their chosen area.

Conclusion

Freehold condominiums in Singapore offer a unique opportunity for investors to secure long-term ownership and stable investment value. From their resilience in market fluctuations to the security of perpetual ownership, freehold condos are a sound choice for those seeking lasting assets. For buyers like James, freehold properties not only promise stability but also offer a legacy for future generations.

If you’re ready to explore freehold condos and make informed investment choices, start browsing our listings and resources for valuable insights into Singapore’s premium real estate market.