Buying a freehold condo in Singapore can be a complex process, especially with financing rules like the Total Debt Servicing Ratio (TDSR). TDSR determines how much you can borrow based on your income and existing debts. It helps banks ensure that borrowers don’t take on more debt than they can handle. In this guide, we’ll break down everything you need to know about TDSR, including how to calculate it, what types of loans it covers, and ways to manage it.

1. What is TDSR and Why Was it Introduced?

TDSR stands for Total Debt Servicing Ratio. It’s a rule that limits the portion of your income that can go toward debt payments. TDSR is capped at 55% of your monthly income. In other words, all your monthly debt payments combined shouldn’t exceed 55% of what you earn.

Purpose of TDSR

The Singapore government introduced TDSR in 2013. Its purpose was to curb excessive borrowing and prevent a housing market bubble. By limiting debt, TDSR ensures that property buyers don’t over-leverage themselves.

MSR vs. TDSR: MSR, or Mortgage Servicing Ratio, applies only to HDB and Executive Condominiums, capping the amount of income used for mortgage payments at 30%. TDSR, on the other hand, applies to all property loans.

TDSR Ratio: A good TDSR ratio is below the 55% limit, allowing room for loan eligibility.

2. How to Calculate TDSR in Singapore

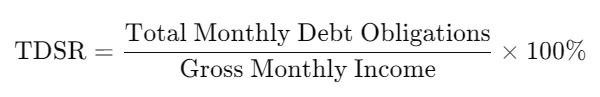

To calculate TDSR, divide your total monthly debt obligations by your gross monthly income, then multiply by 100.

Example Calculation

If your monthly income is $5,000 and your monthly debt payments total $2,000, your TDSR will be 40%. In this case, your TDSR is within the 55% cap, so you qualify for additional borrowing.

Specifics for Singapore

Credit Card Debt in TDSR: Outstanding credit card balances count toward your TDSR calculation. This includes monthly payments or minimum payments

How to Calculate TDSR Singapore: In Singapore, only fixed, regular income is counted. Variable income, like bonuses, may be adjusted by lenders.

Monthly Income Calculations: Lenders typically consider your base salary and may only count a portion of variable income.

3. Debt Types and Their Impact on TDSR

Types of Debt Included in TDSR

- Credit Card Debt: Credit card payments impact your TDSR, even if you pay the balance monthly.

- Car Loans and Personal Loans: Car loans add to your monthly debt obligations and increase your TDSR.

- Mortgage Loans (HDB and Private Properties): Both HDB and private property loans factor into TDSR calculations. If you’re refinancing, TDSR still applies.

Special Cases

Allowance and Variable Income: Some lenders include allowances and bonuses in TDSR but at a reduced rate.

Guarantor and TDSR: If you’re a guarantor on someone else’s loan, it may count toward your TDSR.

How TDSR Affects Loan Eligibility and Borrowing Capacity

Borrowing Limits with TDSR

TDSR directly affects how much you can borrow. Even with high income, if you have significant debts, your borrowing capacity will be limited.

What Happens if TDSR is High?

If your TDSR exceeds 55%, lenders may refuse the loan or offer a smaller amount. For instance, high credit card balances can make a mortgage harder to secure.

Strategies for Managing TDSR

Securing a Loan with High TDSR: Some borrowers pledge assets to reduce TDSR or work with a financial advisor for strategies.

Reduce Debt Obligations: Pay down debts to improve TDSR.

Increase Gross Monthly Income: Boosting your income helps lower your TDSR ratio.

Frequently Asked Questions About TDSR

Loan-Related Questions

- Can TDSR Be Ignored? Banks are obligated to follow TDSR, so it cannot be ignored.

- Does TDSR Apply to Credit Card Debts? Yes, credit card balances affect your TDSR.

- How Does Balance Transfer Affect TDSR? Balance transfers may consolidate debt but still impact TDSR.

Specific Situations

- Can I Exclude My Car Loan from TDSR? All loans, including car loans, usually count toward TDSR.

- Does a Guarantor Increase TDSR? Being a guarantor may affect your TDSR, depending on the lender.

- Is TDSR Required for Property Refinancing? Yes, TDSR applies to property refinancing.

Technical Queries

What’s the Maximum Age for TDSR? TDSR generally applies to borrowers up to 65 years old, but lenders may make exceptions.

What is Pledged Deposit for TDSR? Pledging assets can sometimes offset TDSR.

Must Both MSR and TDSR Be Applied? Yes, for HDB loans, MSR and TDSR both apply.

Increasing Your TDSR Eligibility: Practical Tips

- Increasing Income: Consider additional income sources, such as renting out rooms, to increase gross monthly income and lower TDSR

- Reducing Debts Strategically: Prioritize paying off high-interest loans to reduce your TDSR efficiently.

- Working with a Financial Advisor: Avoid balance transfers or adding unnecessary debt, which can increase your TDSR.

Conclusion

TDSR plays a significant role in determining your borrowing capacity in Singapore’s property market. By understanding how TDSR works, how to calculate it, and how to manage it, you can make informed financial decisions and maximize your loan eligibility. For the best results, consider consulting a mortgage broker or financial advisor to navigate TDSR and create a borrowing plan that aligns with your property goals.