What is an Executive Condominium

Executive condominiums (ECs) in Singapore offer a unique blend of affordability and private condo living, making them a popular choice among middle-income families and first-time buyers. ECs were introduced to meet the needs of Singaporeans who desire private condo amenities but may find fully private properties financially out of reach. Offering facilities like pools, gyms, and landscaped gardens, ECs bridge the gap between public housing and high-end private condos, providing buyers with both luxury and value.

For those who meet the eligibility criteria, Executive condominiums present an incredible opportunity to secure a long-term investment. With government subsidies and the potential for appreciation, ECs transition into private properties after a 10-year period, often resulting in significant value growth. Whether you’re a young family looking for an affordable home with premium features or an investor seeking properties with future resale potential, executive condominiums provide a compelling alternative in Singapore’s real estate market.

This guide will explore the essentials of buying an executive condominium, including eligibility requirements, benefits, financing options, and long-term investment potential. Let’s dive into everything you need to know to make an informed decision on ECs in Singapore.

What is an Executive Condominium?

Definition and Background

An Executive Condominium (EC) is a unique type of housing in Singapore, designed to bridge the gap between public housing (HDB flats) and private condominiums. Introduced by the government in the 1990s, ECs are aimed at Singaporeans who desire private condo-style amenities but find fully private properties out of financial reach. ECs provide a similar living experience to private condos, featuring facilities like swimming pools, gyms, and security within a gated community. However, they come with certain restrictions and government subsidies that make them more affordable for eligible buyers.

Characteristics of ECs

Executive Condominiums are developed and sold by private developers, but only Singaporean citizens are eligible to buy them during the initial launch phase. ECs come with private condominium features, including landscaped surroundings, shared amenities, and modern architectural designs. Buyers enjoy the exclusivity and lifestyle associated with private condos but at a more accessible price, thanks to government support during the initial phase

Eligibility and Maximum Income Cap for EC Purchase

Eligibility Requirements

To qualify for an Executive Condominium (EC) in Singapore, buyers must meet specific eligibility criteria set by the government. First, at least one applicant must be a Singapore citizen, and any co-applicants must be either Singapore citizens or permanent residents. Additionally, buyers must form a “family nucleus,” which includes options like married couples, parents and children, or siblings. The EC scheme is aimed at middle-income families, and applicants cannot currently own private property or have disposed of one in the 30 months prior to their application.

Eligibility Requirements

To qualify for an Executive Condominium (EC) in Singapore, buyers must meet specific eligibility criteria set by the government. First, at least one applicant must be a Singapore citizen, and any co-applicants must be either Singapore citizens or permanent residents. Additionally, buyers must form a “family nucleus,” which includes options like married couples, parents and children, or siblings. The EC scheme is aimed at middle-income families, and applicants cannot currently own private property or have disposed of one in the 30 months prior to their application.

Can Singles buy Executive Condos

The short answer to this question is yes. However, Singles who want to buy Executive Condominiums will need to find two other single Singaporean friends to participate in the Joint Singles Scheme where they can purchase their flat as long as their joint income does not exceed $16,000

Income Cap for EC Buyers

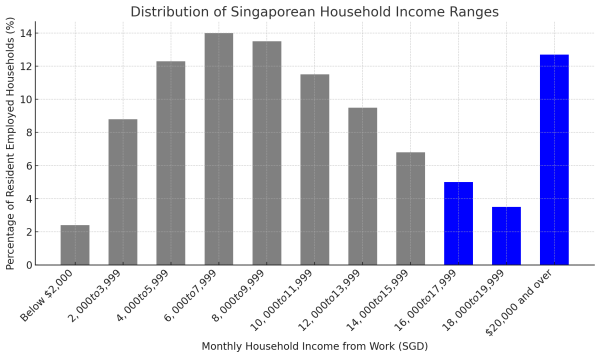

One key restriction for buying an EC is the maximum household income limit. Currently, the income ceiling for EC eligibility is SGD 16,000 per month. This cap is designed to keep ECs accessible to middle-income families who may not qualify for HDB flats but may also find private condos beyond their budget. This income limit is a significant factor for potential buyers, as exceeding it disqualifies applicants from purchasing an EC. If you look at the following distribution of Singaporean household income, the cap of SGD 16,000 a month will exclude those who belong to the blue shaded columns

Appealing to Middle-Income Families

Executive Condominiums are particularly attractive to middle-income families who fall between the affordability of HDB flats and the high prices of private condos. For buyers within the income ceiling, ECs offer a unique opportunity to enjoy a private condo lifestyle without the full financial burden typically associated with private property.

Key Benefits of Buying an Executive Condominium

Affordability with Condo Facilities

Executive condominiums (ECs) offer private condo amenities at a more accessible price, thanks to government subsidies. ECs like Piermont Grand in Punggol provide a luxurious living environment with facilities such as swimming pools, gyms, and BBQ areas. Set along the Punggol Waterway, Piermont Grand offers residents waterfront views and a peaceful atmosphere while remaining affordable for eligible buyers. Families and young professionals enjoy the private condo lifestyle without the high price tag associated with private developments.

Potential for Appreciation

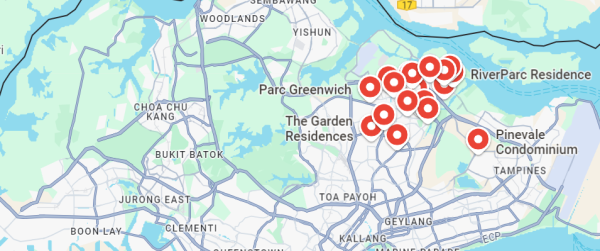

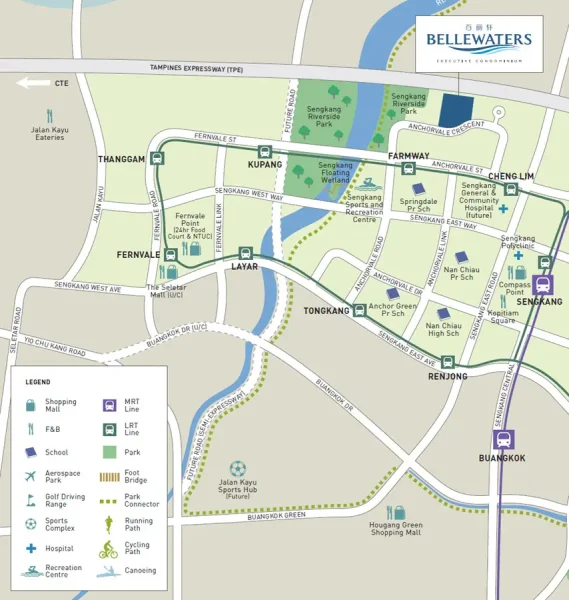

One of the most compelling aspects of ECs is their potential for capital appreciation. ECs like Parc Canberra in Sembawang and Parc Greenwich in Fernvale are highly sought after due to their strategic locations near MRT stations, schools, and shopping centers. After a 10-year period, ECs are fully privatized, often resulting in a rise in market value. Investors who purchase ECs benefit from a property that appreciates over time, especially as it transitions from subsidized housing to a private asset that appeals to a broader market, including foreigners.

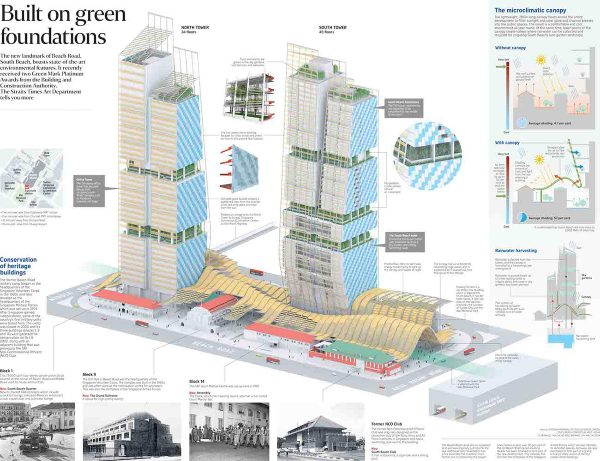

Upgrading to Private Ownership

Freehold condo investments in prime locations often promise robust rental yields and long-term appreciation. For example, properties such as South Beach Residences, a luxury freehold condo near Marina Bay, are in high demand among expatriates, making them ideal for investors seeking rental income. With rental yields around 3-4% annually in prime areas, these freehold condos often yield better long-term returns than their leasehold counterparts. By calculating ROI based on both rental yield and potential property appreciation, investors gain clarity on the financial benefits that a freehold property can provide.

Answering Common Questions

Is it good to buy an executive condo? ECs provide an attractive balance between affordability and luxury, with facilities comparable to private condos. Their potential for appreciation and eventual privatization makes them a sound investment, particularly for middle-income families who value long-term growth and accessibility to quality amenities.

Financing Options and Grants for EC Buyers

CPF Housing Grants

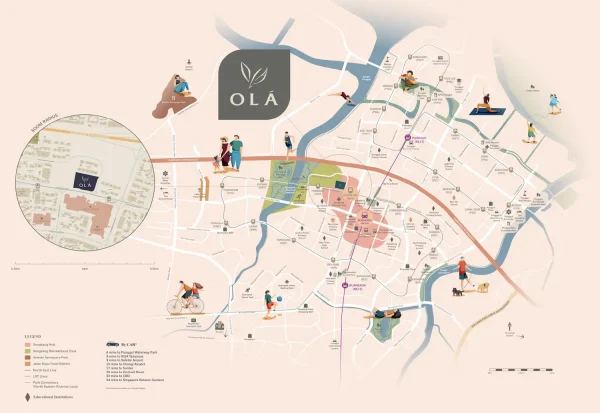

First-time buyers of Executive Condominiums (ECs) can benefit from CPF Housing Grants, which help reduce the upfront cost of purchasing a home. For instance, a family buying an EC like Ola in Sengkang may qualify for the Family Grant, which provides up to SGD 30,000. This grant makes ECs even more affordable for eligible buyers, allowing families to secure a quality home with lower initial financial strain.

Financing Considerations for EC Buyers

Unlike HDB flats, ECs are purchased from private developers, so buyers are ineligible for HDB loans. Instead, EC buyers must secure financing through bank loans. In developments such as Parc Central Residences in Tampines, buyers can opt for financing plans like progressive payment schemes, allowing them to pay in stages as the property is built. This payment structure offers greater cash flow flexibility, particularly for families balancing other financial commitments.

ABSD (Additional Buyer’s Stamp Duty) and Its Impact

For investors, understanding ABSD is crucial when planning additional property purchases. Although ABSD applies to ECs for second or subsequent properties, some buyers have strategically purchased ECs with family members to avoid higher ABSD rates. For example, in a case involving The Visionaire in Canberra, an investor partnered with a sibling to avoid higher ABSD, allowing both parties to enjoy the property’s appreciation potential.

Resale and Upgrading Opportunities

5-Year Minimum Occupation Period (MOP)

Executive Condominium (EC) owners must fulfill a 5-year Minimum Occupation Period (MOP) before they can sell their property on the open market. This regulation keeps ECs primarily for owner-occupiers and discourages speculation. For instance, owners of The Brownstone in Canberra, which was completed in 2017, became eligible to sell their units in 2022. After the MOP, ECs can be sold to Singaporean citizens and permanent residents, opening up resale opportunities and expanding the buyer pool.

10-Year Full Privatization

After 10 years, ECs become fully privatized, allowing sales to foreigners. Developments like Ecopolitan in Punggol, which was completed in 2016, have attracted interest from international buyers due to their high-quality facilities and attractive locations. This transition to full privatization boosts resale value, as foreign buyers enter the market, particularly in ECs located near major business hubs or lifestyle amenities.

Important Factors to Consider When Buying an Executive Condominium

Location and Amenities

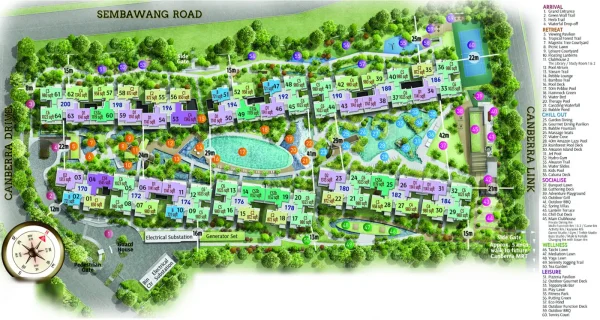

The location of an Executive Condominium (EC) plays a crucial role in its long-term value and appeal. For instance, Piermont Grand in Punggol is located along the scenic Punggol Waterway and is near Punggol MRT, offering residents easy access to nature, transportation, and lifestyle amenities. Similarly, Parc Canberra in Sembawang is close to the Canberra MRT station and several parks, making it an attractive choice for families seeking a balance between urban convenience and green spaces. Choosing an EC near MRT stations, schools, and shopping centers can significantly impact its desirability and future resale value.

Developer Reputation and EC Project Quality

When purchasing an EC, it’s essential to consider the reputation of the developer, as it impacts the quality and durability of the property. Reputable developers like CDL (City Developments Limited) and Qingjian Realty have delivered high-quality EC projects such as The Criterion and Bellewaters, known for their well-designed layouts and premium finishes. Buyers can have more confidence in the long-term maintenance and quality of these ECs, which is critical for both comfortable living and potential resale value.

Investment Potential and Market Conditions

ECs often hold strong investment potential, particularly in areas with high growth and development prospects. Copen Grand in Tengah, for example, is Singapore’s first EC in the new eco-friendly “Forest Town,” designed with green features and smart technologies. The development is expected to benefit from future infrastructure plans and the area’s focus on sustainability. As Singapore’s population and urban development expand, ECs in emerging areas like Tengah are likely to see appreciation, providing buyers with both a home and a solid investment opportunity.

Conclusion

Executive condominiums (ECs) in Singapore present a unique opportunity for middle-income families and first-time buyers to enjoy the perks of private condo living at a more affordable price. With government subsidies, quality amenities, and long-term appreciation potential, ECs offer a solid pathway to property ownership and investment growth. From eligibility requirements and financing options to the resale benefits after the 5-year MOP and 10-year privatization, ECs provide flexibility and value for those who plan to upgrade to private property ownership over time.

Whether you’re looking for a family-friendly home or a property with future resale potential, ECs strike an ideal balance between affordability and luxury. Explore available executive condominiums to discover a property that aligns with your lifestyle, budget, and long-term goals. By choosing an EC, you’re not only securing a comfortable living space but also making a wise investment in Singapore’s competitive real estate market.